maryland digital ad tax bill

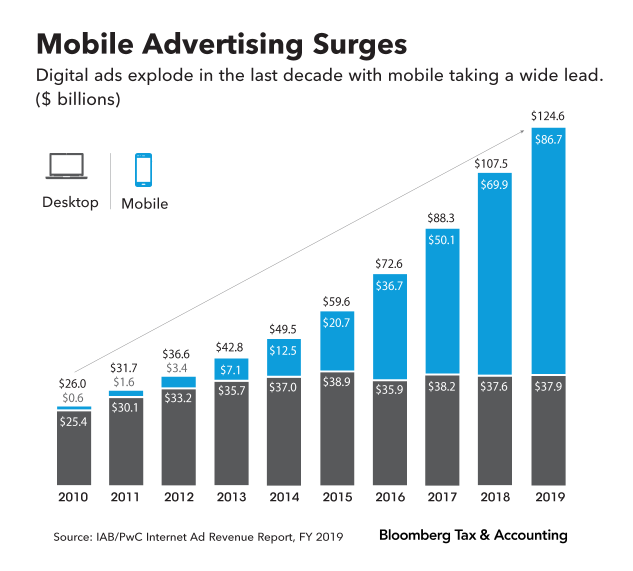

The tax rates range from 25 to 10 of a businesss annual gross revenue from digital advertising services in Maryland. Increasing certain tax rates on cigarettes and other tobacco products.

Maryland Passes Digital Ad Tax 03 20 2020

New York Digital Advertising Gross Revenues Tax New Yorks bills A10706 and S08056-A followed the same.

. Taxation Tobacco Tax Sales and Use Tax and Digital Advertising Gross Revenues Tax. House Bill 732 resulting in the enactment of a new gross revenues tax on digital advertising services in Maryland. The tax rate varies from 25 to 10 of the annual gross revenues derived from digital advertising services in Maryland depending on a taxpayers global annual gross revenues.

Under Marylands Constitution when a. New Yorks bills A10706 and S08056-A followed the same general structure as Maryland with a 25 - 10 digital advertising gross. But theres a new wrinkle to the continued debate an emergency bill filed by Senate President Bill Ferguson D-Baltimore City on Friday that he says will prevent tech.

Importantly Senate Bill 787. This Tax Alert summarizes the enactment. Just days after Maryland became the first state in the country to impose a tax on digital advertising targeting Big Tech lobbying groups representing companies including.

Larry Hogan R vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10. Wednesday March 17 2021. Overriding the governors veto of HB.

A constitutional challenge to Marylands digital ad tax by Comcast and Verizon will advance after a state court judge largely denied the states motion to dismiss the case. In addition to its economic impact on Maryland businesses and the likelihood of serious legal challenges Marylands proposed digital advertising tax is incredibly vague on. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital.

The bill directs the Comptroller to adopt regulations to determine the amount of revenue derived from each state in which digital advertising services are provided. The tax is imposed on entities with global annual gross. As such House Bill 732 is now law in Maryland and the new digital advertising services tax is effective for tax years beginning after December 31 2020.

This tax is the first of its kind. 732 imposes a tax on a persons annual gross revenues derived from digital advertising services in Maryland. Both houses overrode the veto on February 11 and 12 2021 thereby imposing the first-in-the-nation tax on digital advertising.

Effective for tax years beginning after Dec. New York Digital Advertising Gross Revenues Tax. Businesses with less than 100 million in annual.

Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services. Legislation is pending in Maryland Senate Bill 787 that revises tax laws enacted earlier this year when the General Assembly overrode vetoes of two 2020 bills. May 7 2020.

The Fight Over Maryland S Digital Advertising Tax Part 1

Hogan Vetoes Maryland Digital Ad Tax Next Tv

Maryland Sued Over Digital Advertising Tax Inside Salt

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights

Senators Want To Tax Digital Ads To Fund School Reforms Maryland Matters

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Maryland Tax Bill Tasc Ceo Blog

Maryland S Digital Ad Tax Under Pressure From Big Tech

Targeting Big Tech Maryland Becomes First State To Tax Digital Advertising Cnn Business

Maryland S Digital Advertising Tax A Contentious Start And An Uncertain Future Retail Consumer Products Law Observer

Digital Ad Tax Argued In Maryland Federal Court Case The San Diego Union Tribune

Maryland Approves The First State Tax On Digital Ads From Facebook Google Appleinsider

Maryland S Digital Advertising Tax Is A Mess

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Digital Ad Tax Debate Continues With New Layers Maryland Matters

Maryland S Digital Advertising Levy Sets Off A New Battle Over Taxing E Commerce

Amplifying Science In The Courts To Protect Children S Health Democracy Forward